Image source: Getty Images

You can deduct a portion of your leased car expenses when you use it for business. Follow The Ascent’s guide to choosing the best method for deducting your vehicle expenses.

I’ll leave it to the financiers at The Motley Fool to tell you whether you’re better off leasing or buying a car. But regardless of how you got the keys in your hand, you can take a deduction for the business use of your car.

Overview: What is a car lease tax write off?

The business use of your car — owned or leased — is a deductible business expense. Whether a personal or business lease, you get a deduction for hauling supplies from your office to a client or taking a road trip to check out a new retail space.

Deducting a portion of your car lease lowers your business’s taxable income. A car lease deduction is just one of many small business tax deductions that can bring down your tax bill.

How much of a car lease can you write off?

Often, business owners’ personal cars double as their business cars. You deduct costs proportionate with the miles driven for business. However, personal travel, including commuting, can’t be written off on your business taxes. You read that right: Your work commute doesn’t qualify as business travel.

There are two methods for writing off leased car expenses: actual costs and standard mileage rate. The method you choose at the beginning of the lease is the one you stick with until you return the car to the dealer, so choose wisely.

Car depreciation is reserved for vehicles you own, not lease. Certain leased cars qualify for a section 179 vehicle deduction, potentially allowing you to take a first-year deduction that exceeds your actual lease costs for the year. The catch: You’re waiving the ability to write off any more leased car expenses for the rest of the lease.

Talk to a tax professional about the tax implications before going the section 179 route; you’re probably not going to get the most tax savings that way.

1. Actual cost method

As the name suggests, you’re deducting the actual costs of your leased car. Eligible expenses include your lease payment, gas, oil, tires, tune-ups, registration fees, and insurance. Keep track of those receipts.

If you drive the car for personal trips, you can’t deduct the entirety of your leased car’s costs. Of the total miles driven during the year, find the percentage of the total miles driven for work, excluding commuting.

For example, say your leased car costs you $8,000 per year in car payments, gas, and insurance. You drove the car 12,000 miles, one-quarter of which consisted of personal trips and commuting to work. The business deduction is three-quarters of your actual costs, or $6,000 ($8,000 × 0.75).

2. Standard mileage rate

More simply, you can take a flat-rate deduction for every business mile driven in your leased vehicle. Taxpayers often opt for the standard mileage rate method because it requires less number crunching.

The IRS mileage rate changes slightly every year. The rate in 2019 was $0.58, and it sits at $0.575 in 2020.

Let’s continue with the previous example. A leased car driven 9,000 miles for business equates to a $5,175 deduction [(12,000 miles − 3,000 personal and commuting miles) × 0.575 IRS mileage rate].

Which car lease write-off method is better?

You’ll want to run an analysis to pick which car lease write-off method produces the highest deduction. Since you can’t change your car lease deduction method, consider your mileage and car expenses over the entire life of your lease, not just the first year.

Predicting how you’ll use your car and what costs you’ll incur is like making any plan for the future: You might have a vague idea of what will happen, but you could be terribly wrong. Keep that in mind as you go through this exercise.

1. Estimate the number of personal and business miles you’ll drive

You can only deduct the cost of using your car for business, and your daily commute doesn’t count as business mileage. Think about business trips, running business errands, and client visits when estimating the number of miles you’ll drive over the course of your lease.

Your financial forecasts can help you estimate your annual mileage. Say you’re planning to open a new storefront in the next state over. Expecting to spend more time in your car over the three-year lease, you estimate the following.

|

Year 1 |

Year 2 |

Year 3 |

Total |

|

|---|---|---|---|---|

|

Business miles |

15,000 |

20,000 |

25,000 |

60,000 |

|

Personal and commuting miles |

5,000 |

5,000 |

5,000 |

15,000 |

|

Total miles |

20,000 |

25,000 |

30,000 |

75,000 |

According to your miles estimate, your car is 80% used for business and 20% used for personal purposes (60,000 business miles ÷ 75,000 total miles). We’ll need that for step three.

2. Estimate your IRS standard mileage deduction

The IRS can change the mileage rate annually, but there’s no way to project future rates. Use the current-year standard mileage rate to estimate your annual IRS mileage deduction. Then, multiply your estimated business miles by the current-year IRS mileage rate to get your estimated deduction.

|

Year 1 |

Year 2 |

Year 3 |

Total |

|

|---|---|---|---|---|

|

Business miles |

15,000 |

20,000 |

25,000 |

60,000 |

|

Estimated IRS mileage deduction |

$8,625 |

$11,500 |

$14,375 |

$34,500 |

Your estimated IRS mileage deduction is $34,500 over the course of your lease.

3. Tally your car lease costs

Add up all the costs associated with your leased car: lease payments, insurance costs, gas, and repairs costs. Don’t include parking and tolls, which are separately deductible.

Include the cost of the personal portion of your vehicle in the calculation.

|

Year 1 |

Year 2 |

Year 3 |

Total |

|

|---|---|---|---|---|

|

Lease payments |

$6,000 |

$6,000 |

$6,000 |

$18,000 |

|

Insurance |

$2,500 |

$2,500 |

$2,500 |

$7,500 |

|

Gas |

$3,000 |

$3,500 |

$4,000 |

$10,500 |

|

Repairs |

$1,000 |

$1,000 |

$1,000 |

$3,000 |

|

Subtotal |

$12,500 |

$13,000 |

$13,500 |

$39,000 |

|

Business percentage |

80% |

80% |

80% |

80% |

|

Deductible expenses |

$10,000 |

$10,400 |

$10,800 |

$31,200 |

You can expect to write off $31,200 in car lease costs under the actual cost method.

4. Choose the winning method

After comparing the results of steps two and three, choose the method that produces the highest deduction. In our example, you’re slightly better off selecting the IRS standard mileage deduction method ($34,500 IRS mileage deduction method vs. $31,200 actual cost method), but the difference isn’t meaningful enough to be conclusive.

When both methods produce a similar outcome, as is the case here, you’re not necessarily closer to choosing the winning method. If it were me, I’d go for the standard mileage rate method because it’s easier to implement than the actual cost method.

You can’t go wrong talking to a tax professional to identify which method works best to lower your small business tax liability.

How to deduct sales tax on a car lease

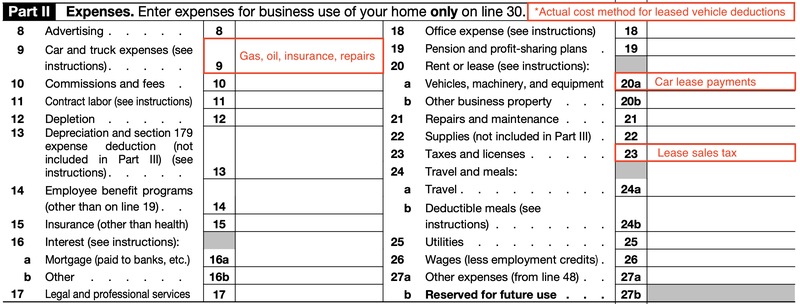

If you’re using the actual cost method to write off your car lease, you deduct your monthly sales tax on a separate line on your business tax return. Those who opt for the standard mileage rate deduction can skip this step.

As a sole proprietor or single-member LLC, you’ll report and deduct car lease sales tax on Form 1040 Schedule C. Your gas, repair, and insurance costs go on line 9, and your car lease payments go on line 20a. Report car lease sales tax on line 23.

Sales tax and lease payments are reported separately from your other car costs. Image source: Author

Your tax software can walk you through filling out Schedule C correctly.

Beep beep! Tax deductions coming through!

You might not immediately think of deducting a portion of your car lease when you use your car for business only some of the time. But don’t stop here: Take a look at other self-employed tax deductions you might be missing.