Investment Thesis

An emerging threat to oil and gas companies, environmental rulings by judges are causing billions of dollars in economic damages, delaying, altering, or cancelling projects, and proving to be a very real and present risk factor to the industry. Keeping tabs on these developments and the risks they pose may become an important micro investor strategy for those investing in the industry.

Let’s See How Far We’ve Come

Fossil fuels have a bad reputation, one that was deserved in bygone years (as was the case for many industries), but one that is unfairly given in an era of environmentally conscience industries who have put tremendous initiative and development into reducing emissions and preventing and cleaning up spills.

Yet, regardless of the fairness of such reputation, the crusade against fossil fuels, and in particular oil and gas, has only increased in fervor and pitch. With past tactics of trying to demonize drilling as being unsafe, then moving on to “fracking” when that failed, then moving on to emissions when that failed – all thwarted by actual data and science – the environmentalist lobby seemed to be losing effectiveness.

Fortunately for them, and unfortunately for the industry and all it supports (everyone), the environmentalist lobby has suddenly found success in the courts. District judges who live hundreds if not thousands of miles away from the projects they are given jurisdiction over have increasingly been ruling in favor of the environmentalist lobby. Decades of relative confidence in property rights and development are being upturned by the fallout of the Obama Administration’s memorandums and executive orders on development on federal lands, protections of threatened species, and environmental protection.

The Age of Activism

As with recent political activism by the courts in relation to items such as travel bans and immigration, the oil and gas industry has found itself in the cross hairs of activist federal judges. With increased frequency, it’s clear that this is a new age, one that will not see much respite unless and until these judges are unseated and the rule of law returns. Here we’ll highlight two recent instances of such activism, which both provide layers of risk in different areas to the oil and gas industry.

Pretty Bird

The first example highlights the risk to exploration and production companies who lease federal minerals to develop, or who have federal minerals offsetting their fee (private) and state mineral leases, and must deal with federal regulations when pooling those federal leases in to their drilling and spacing units.

Federal minerals onshore are managed and regulated by the Bureau of Land Management (BLM). As part of their mandated responsibilities, they are to offer for lease and development federal minerals, periodically throughout each year, so as to realize the value of the public resources therein. These lease sales typically occur quarterly, and are open to the public.

In February of 2020, U.S. Chief Magistrate Judge Ronald E. Bush ruled in favor of multiple environmentalist groups who had sued to attempt to block lease sales in Wyoming and Utah. A full brief can be found here, with pertinent information relayed below.

In the ruling, Bush declared that the Trump Administration’s BLM Memorandum of 2018 in regards to streamlining the lease process in order to remove unnecessary waste, costs, and delays, conflicted with the Obama Administration Memorandum of the year prior. The main sticking point for Bush had to do with the public comment period for notice-and-comment rulemaking, which he declare applied to this Memorandum. However, the Obama Administration Memorandum never went through that process, as Instruction Memorandums typically do not. In essence, Bush decided that he would give more authority to a past president’s orders than the current President’s orders. While the legality and logic of this is troubling, the impact was substantial.

With the ruling, made in February of 2020, the BLM lease sales of:

- June 2018 – Wyoming

- June 2018 – Nevada

- September 2018 – Wyoming

- September 2018 – Nevada

- September 2018 – Utah

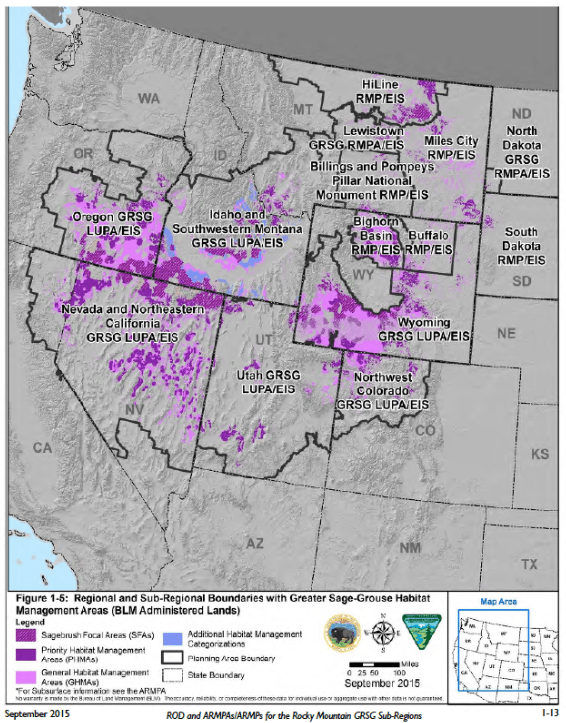

Were ruled invalid, as it pertained to the portions within the greater sage grouse habitat management areas, which encompass much of Wyoming and portions of Utah, Colorado, and Montana, as it pertains to oil and gas basins:

Source – The Oil and Gas Report

The ruling was immediately appealed by industry groups, the BLM, the State of Wyoming, and the Secretary of the Interior, and ongoing proceedings continue to this day.

The June 2018 Wyoming lease sale alone, which occurred entirely in the sage grouse management area, netted the US Taxpayers $35.675 MM in lease bonuses, according to the sale results.

Aside from the initial lease payments the E&P companies made to obtain the right to develop these minerals, they also have incurred millions in administrative costs for spacing, permitting, obtaining right of ways, and running title across these lands. Some companies have gone so far as to invest tens of millions more in drilling, completing, and producing wells on these leases.

Now, this activist judge has made a severe mess of things, all of these leases are in suspense while proceedings continue as to the order and its challenges, the US Taxpayers are not receiving royalty payments from the producing wells on the leases since they are shut-in, and the industry is left with significant uncertainty and lack of confidence in leasing and developing federal lands.

DC to Dakota: Who’s Authority?

The second recent example hits the industry in other ways. On Monday July 6th, 2020, DC District Judge James E. Boasberg, appointed by Obama in 2010 and confirmed in 2011, continued his years-long activism and shockingly ruled in favor of lawsuits to shut down Energy Transfer LP’s (ET) Dakota Access Pipeline, in regards to a roughly 1,000′ section that goes underneath a portion of a lake, wherein the lake is federal land. In March he had ruled that the US Army Corps of Engineers, who had issued the permit, in 2017, must conduct a full Environmental Impact Study,

Developed and completed with much stoked up controversy and protest, the pipeline has become the leading single source of transport out of the Williston Basin, wherein lies the Bakken Shale play, currently transporting 570 MBOPD out of the basin’s 1.2 MMBOPD as of last official count in April of this year, or roughly 48% of the basin’s crude.

Despite the federal government approving of the project after environmental review as it pertained to this

crossing, which simply ran parallel to two existing pipelines crossing at the same spot, and despite being in service for over three years now without issue and with modern monitoring and maintenance, Boasberg decided to insist that his order in March that they re-do the environmental assessment was not enough, that the pipeline must be emptied and await the duplicate environmental review.

Though ET immediately filed for a stay, it was denied on Tuesday, and they are now working their appeals up the chain of courts. Though they are confident that the study will result in a return to operation, the delay of the study is estimated to be 13 months, and will cause severe damage, not only to ET, nor to the royalty owners in North Dakota, but also to the E&P companies in the Williston Basin, who now have to look for new routes for their oil to take, of which options are limited and/or much more expensive, i.e. via rail. Ironically, there is far more environmental risk and health risk with these barrels traveling by rail, than by pipeline.

The Army Corps of Engineers estimated in court filings that the economic impact of the shutdown would exceed $1B. That math is easily supported by adding up the 13 months of shut-down, or roughly 225 MMBO, and applying a $5/bbl increase in transportation cost to those barrels, for a total of $1.125 B. However, ET estimates as much as 300,000 BOPD could be shut in entirely during the review period, as they won’t have available outlets without the pipeline. At the current oil price of $40/bbl, those barrels would have a far greater impact of roughly $4.74 B.

Quite an Impact

According to BLM Statistics, as of the end of FY 2018, there were 25.5 MILLION BLM acres actively leased and under development. With millions more acres under federal control on Indian Reservations and unleased BLM, the potential impacts of activist judges is massive. Not only as to the example of direct impact on E&P companies with their leases, but indirect impacts via pipelines that cross federal lands, pooling of spacing units, and environmental impact restrictions.

Investing Path Forward

As an investor, these recent developments add to the many existing risks and trials facing the industry currently. It continues to be important to drill down and do due diligence.

This is not an easy task, unfortunately. However, some levels can be achieved per the following methods.

Vetting Company Exposure to Federal Lands and Impacts

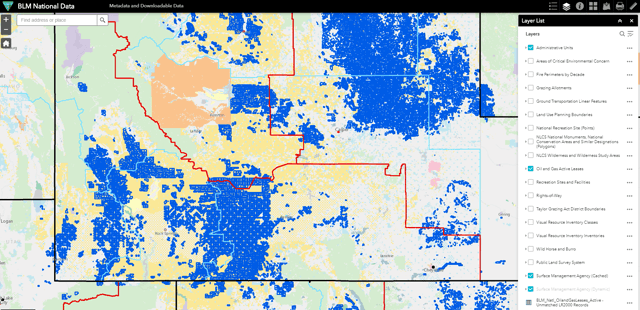

This can be hard to do without being familiar with company acreage positions and pipeline routes. However, most companies have readily available maps in investor presentations, which can be compared to BLM maps like the one of Wyoming below:

With some experience in these matters, here is a partial list of interest of E&P companies with significant BLM and Federal exposure:

- EOG Resources, Inc. (EOG)

- Devon Energy Corporation (DVN)

- Matador Resources Company (MTDR)

- Chesapeake Energy (CHKAQ)

- Occidental Petroleum Corporation (OXY)

- Continental Resources, Inc. (CLR)

- ConocoPhillips (COP)

There are many more with significant exposure, including on the reservations in North Dakota, Utah, Colorado, and New Mexico. Further, as you can see from the map, pipelines are hard pressed to avoid federal lands, which exposes most other E&P companies and midstream companies to these risks.

Keeping Tabs on Lease Offerings, Protests to Them, and Sales Results

This too takes a little bit of work, but is not too troubling. The first thing to note is that every single lease sale is protested by the same parties over and over (Wild Earth Guardians have a wonderful budget somehow), and that keeping tabs on them can be mundane. However, the process for lease sales can be found at this link. Drilling down further by state gets you to the notices, comments, parcel lists, etc.

Once a sale goes live, it occurs on the website EnergyNet. Though you do not have to be registered to view government sales, you would need to register to bid, both with EnergyNet, and the BLM at each sale.

Post-auction, the BLM posts the sales results, as does EnergyNet.

During the process, parcels that need more environmental review may be withdrawn, and that is a somewhat common occurrence. It can, however, be a red flag to those parcels surrounding the lease.

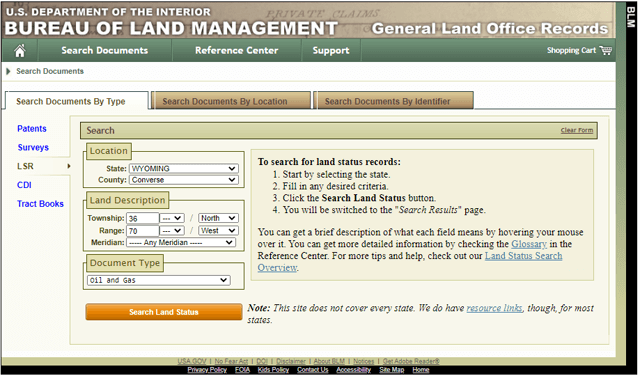

Drilling Down on Specific Leases

If you want to really drill down and follow developments with federal leases, you can use the BLM Land Status Records website to search for specific lands and find federal lease numbers. In order to find oil and gas, simply fill out the state, county, township and range, and select oil and gas. An example is shown below:

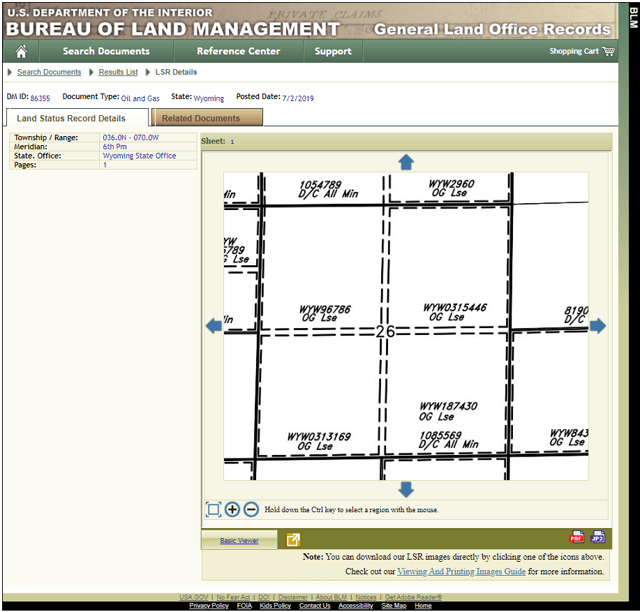

Hitting “Search Land Status” will bring you to a plat. As shown below, the parcels with dashed boundaries are federal leases. The “WYW” followed by a multi digit number indicates the specific lease number. This lease can also be found in the sales results posted by the BLM, but method can help you visualize what is around the specific leases.

If we zoom in on the map to section 26, we can see that the south-east quarter of the section comprises a BLM lease, with number “WYW 187430”:

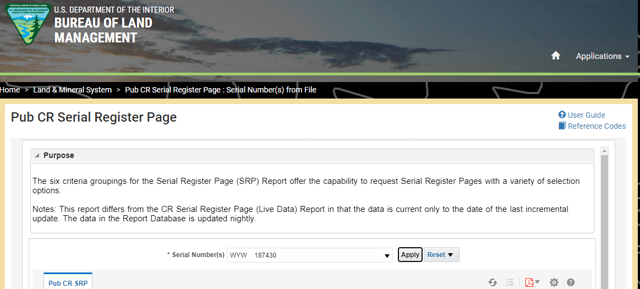

Now, if we want to explore that specific lease, we go to the BLM Public Serial Register Page website.

Once there, we input the subject lease into the search bar. Note that the website has odd formatting rules, so you have to put four (4) spaces between WYW and the number, and then hit “apply”:

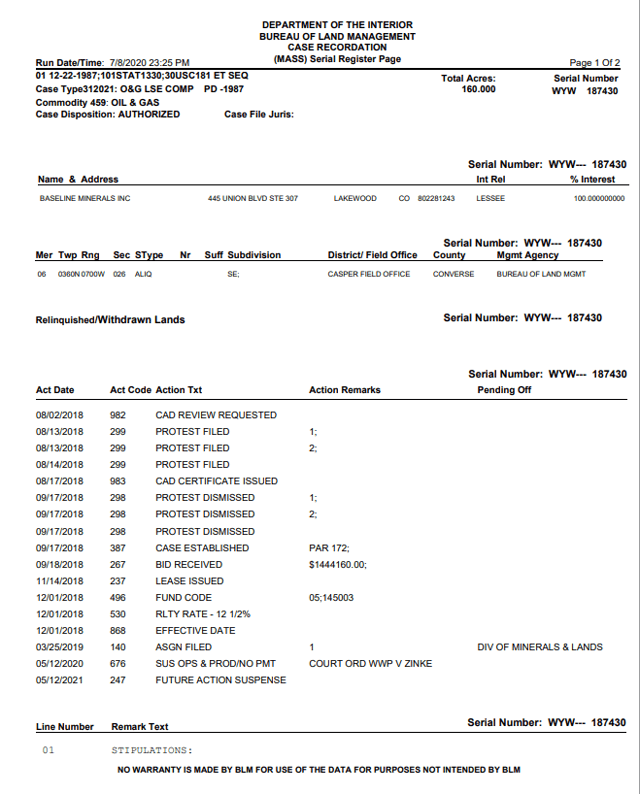

The application then generates the lease serial register page, which shows a lot of useful information, including the acres, who owns the lease, when it was leased, for how much, what actions have occurred, etc. Looks like there’s a legal issue with this particular lease:

The application then generates the lease serial register page, which shows a lot of useful information, including the acres, who owns the lease, when it was leased, for how much, what actions have occurred, etc. Looks like there’s a legal issue with this particular lease:

Using this method, you can keep track of individual leases.

Conclusion

It’s not easy being an oil and gas industry investor. There’d be enough problems with the decisions that many companies make, the lack of transparency, the price impacts of pandemics, the supply impacts of oligopolies, etc. The recent allies the environmentalists have found in activist judges throws yet another risk into the pot, and it is a significant one.

Still, there is value to be found in the industry as an investor, even if it’s betting on the industry’s demise. For longs and shorts, keeping tabs on these developments and drilling down as shown above can give you more insight and help you to make better decisions. Putting in the time and effort to familiarize yourself with the acreage positions and regions as they pertain to federal land for companies you are looking at investing in or betting against can reduce your risks and lead to better investments.