At the starting of this 7 days, I wrote about Russia’s motives for abandoning the OPEC offer in an short article titled “Why Russia Killed The OPEC Deal”. It did not consider lengthy for Russia to make clear its factors in an exclusive interview for Reuters. These investors who are critically intrigued in the oil space need to definitely study the whole Reuters substance (it is short), when I will concentration on the most important details and give my commentary. We’ll also search at what this usually means for the several segments of the oil sector.

The interview was presented by Russia’s deputy energy minister Pavel Sorokin. It is really crucial to maintain in intellect that these kinds of significant-stage officers are not in the business enterprise of furnishing sector examination and forecasts. Rather, they are giving their alerts to the industry.

Without the need of even more ado, let us appear at the crucial factors:

- Russia believes that it is impossible to battle a scenario when the need is consistently slipping, and the bottom is unclear.

- Moscow’s original posture was to increase the agreement without the need of additional cuts for the second quarter. Also, Moscow did not exclude the probability of extending the OPEC deal even additional.

- For Russia, the new cuts would have meant cuts of extra 300,000 bbl/day, bringing the complete cuts to 600,000 bbl/day, which is technologically complicated.

- Sorokin mentioned that oil price ranges in the variety of $45-55 for every barrel are fair and will allow for to make investments in projects and continue to keep offer coming.

- He believes that oil selling prices will maximize to $40-45 for every barrel in the 2nd 50 % of 2020 and proceed their upside to $45-50 in 2021.

- In a Russian-language variation of the job interview (you can operate it as a result of Google translate), he extra that while the ruble-denominated price tag of 3,000 per barrel is really snug, rates in the range of 2,100-2,500 rubles for every barrel are satisfactory. I never know why the authors of the job interview decided to omit this data from the English model as I consider it also sends an vital signal.

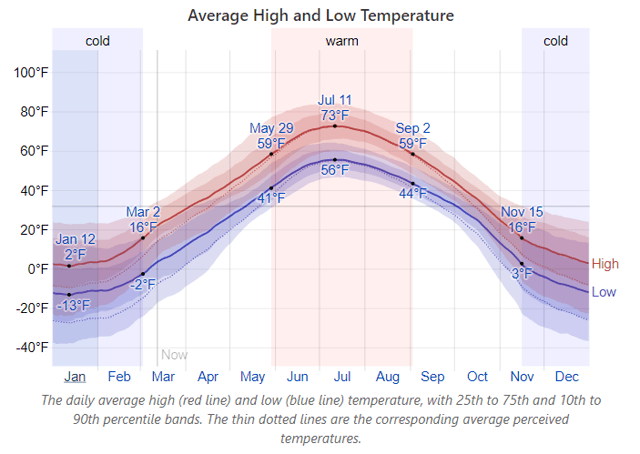

Let us go action by move. When Russia says that it is technologically challenging to regulate output, it says the reality – Russian oil is mostly extracted in unfavorable circumstances. Let us seem at the weather conditions in Nizhnevartovsk, a metropolis that was designed for oil workers who designed the Samotlor industry:

In cold ailments, it is technologically difficult to make downward changes to production, so Russia does not have way too a great deal area for maneuver not like Saudi Arabia whose weather is completely distinctive.

When the creation cuts are implemented and manufacturing reaches some stable amount, trying to keep production at these stages does not demand a lot attempts so Russia’s offer to keep the preceding deal is not astonishing.

Russia’s cold climate is hardly information to any individual. The most appealing element of the interview is the “oil price forecast” aspect, which is, of training course, not a forecast but a sign to other oil producers. The degree of $45-55 will be enough ample to set an conclude to the development of the American shale generation and at the identical time to equilibrium Russia’s funds. Also, the route to $45-55 is offered as a extensive a single (considering that Sorokin does not assume oil to reach $55 in 2021), promising months of hard ache for greater-price tag shale producers, especially those people who are burdened with personal debt.

As I noted over, the ruble-denominated cost of oil is a pretty essential factor. American producers offer oil for bucks and have charges in bucks. Russian producers sell oil for pounds but then convert them into rubles – and have prices in rubles. Therefore, the ruble-denominated value of the barrel of oil is much more important for Russian producers and the Russian finances than the greenback-denominated cost. Russia’s Urals trade with a $3-4 price cut to Brent. As I generate these words and phrases, Brent is buying and selling at $34 for each barrel, when just one dollar purchases you 74.5 rubles. Applying a $4 discount for illustrative functions, we get a ruble-denominated oil rate of 2,235, in line with the suitable amount of 2,100-2,500 rubles per barrel offered by Sorokin.

It is normally demanding to read through the political tea leaves, but in this situation, objective facts seem to healthy perfectly into the subjective narrative – Russia is critical about sustaining small oil rates for a material period of time. So, what does it mean for oil-connected equities?

Given the supplemental issues with coronavirus, both equally WTI (USO) and Brent (BNO) may perhaps come across it tough to rebound from current concentrations and even have additional draw back risks, specially in case Saudi Arabia and UAE turn their stated intentions to raise output into actuality.

The biggest strike arrives to closely indebted offshore drillers, which involve increased oil charges for the considerably-needed upside in dayrates. Valaris (VAL), Noble Corp. (NE), Seadrill (SDRL) find themselves in a incredibly challenging scenario. The environment is a little bit less difficult for Transocean (RIG) and Diamond Offshore (DO) but they facial area the same existential hazards. Shares of other drillers like Borr (BORR) or Pacific Drilling (PACD) will also find them selves beneath strain regardless of the point that they are previously buying and selling in the penny stock zone.

Shale gamers (the two oil and fuel) with personal debt problems have also located themselves beneath pressure: Antero Sources (AR), Chesapeake Electricity (CHK), Whiting Petroleum (WLL), Oasis Petroleum (OAS), SM Strength (SM), Extraction Oil & Fuel (XOG) and the like. While this sort of falling cost charts could eventually current a a single-working day upside option for day traders, it is highly very likely that the prolonged minimal oil price surroundings will force the weaker providers into restructuring.

As a result, everyone eager to speculate will be safer performing this sort of speculations in much healthier gamers like Concho Means (CXO), EOG Means (EOG), Pioneer Natural Assets (PXD) – but continue to keep in mind that there might be far more room to tumble, and that limited sellers have not nonetheless turned their attention to the much healthier bunch – limited fascination in the higher than-mentioned businesses is very low.

Companies – Schlumberger (SLB), Halliburton (HAL), Baker Hughes (BKR) – have presently been materially punished. It is apparent that the extended oil value downside will direct to a significant drop in capex paying out as corporations will try out to survive the downturn by slicing expenses just about everywhere they can. Judging by current dividend yields of oil assistance players

, the marketplace tells us that dividends are unsustainable – and I concur with the market.

I manage my check out that the most effective prospect will ultimately be offered by majors – Exxon Mobil (XOM), Chevron (CVX), BP (BP), Full (TOT), Royal Dutch Shell (RDS.A) (NYSE:RDS.B). Dividend adjustments are undoubtedly probable even in the situation of majors due to the fact no just one understands at this stage how very long the coronavirus problems will last. For all those on the lookout for a deal, the excellent circumstance will be to invest in majors just after a promote-off that follows a dividend slash. Now, there’s worry in the market (and frequently in the planet) so we may possibly see moments when sizzling heads will start out talking about the top demise of significant oil producers – that would be the greatest second to initiate a new posture or to incorporate to an existing 1 if you have made a decision to sit by means of thick and slender.

To sum it up: oil is finding hit by a double blow from the collapse of the OPEC offer and coronavirus containment actions. At the moment, it looks like Russia is incredibly significant about sticking to its new place and trying to deal a blow to the U.S. shale, both for political and for for a longer time-time period market share reasons. The circumstance on the coronavirus entrance gets worse working day by day (when I say this I imply containment steps I’m not an epidemiologist and I are unable to assess the biological effects of the virus and its likely unfold) which is extremely about for oil.

When Brent oil frequented sub-$40 territory back in late 2015-early 2016, it fell in direction of $30 for about five weeks. The rebound to $40 took eight months, and oil traded near $40 for about 4 far more months ahead of it was ready to transfer to the upside. In total, it took oil about 4 months to get firmly back again higher than $40. Presented the latest external shocks that did not exist at that time, it truly is tricky to imagine that oil will have a faster rebound.

This is surely the time of anxiety – and a time of chance. Take care of your threats thoroughly and great luck!

If you like my do the job, you should not forget to click on the major orange “Abide by” button at the top of the display and strike the “Like” button at the base of this report.